Financial Modeling

What is financial modeling?

Financial modeling is the task of building an abstract representation (a model) of a real world financial situation. This is a mathematical model designed to represent (a simplified version of) the performance of a financial asset or portfolio of a business, project, or any other investment.

What financial models are used?

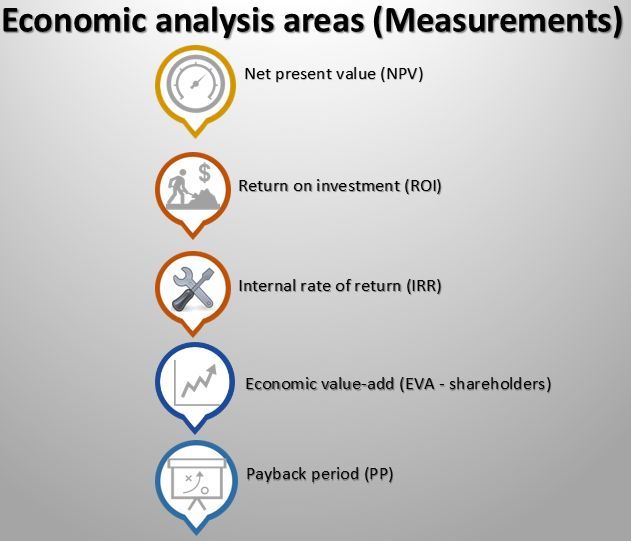

Net Present Value (NPV)

NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. NPV is used in capital budgeting and investment planning to analyse the profitability of a projected investment opportunity or a project.

Return On Investment (ROI)

ROI is a calculation that determines how an investment (or asset created via a project) can be expected to perform or actually performs over a certain period. It expresses gain or loss of an investment.

Internal Rate of Return (IRR)

The IRR is the discount rate that makes the Net Present Value (NPV) of a project ZERO. IRR is used to show the expected compound annual rate of return that will be earned on a project. The IRR is compared to the hurdle rate (cost of capital) to determine the financial viability of a project.

Economic Value Add (EVA)

Economic Value Added or EVA is a tool for gauging the real economic performance of a business and its ability to create shareholder value. EVA provides a means for coupling the two fundamental drivers of economic or share holder value, namely operating earnings and capital efficiency.

Payback Period (PP)

The payback period is the amount of time required for cash inflows generated by a project to offset the initial cash outflow or investment.

What is the benefit of applying the financial models to your business?

Net Present Value

Measured in currency value, a positive NPV indicates that the projected earnings generated by a project exceeds the estimated costs. A project or investment with a positive NPV will be profitable, and a project or investment with a negative NPV will result in a net loss. Only projects or investments with a positive NPV should be considered.

Return on investment

Measured in percentage, the ROI is used to compare the total returns of different investments. The ROI allows a project to be compared and ranked against other projects based on efficiency expressed in percentage terms. This is used to evaluate an investment compared to other investments. An investment in a project that delivers a high ROI in comparison is preferred.

Internal Rate of Return (IRR)

The IRR is the discount rate that makes the Net Present Value (NPV) of a project ZERO. IRR is used to show the expected compound annual rate of return that will be earned on a project. The IRR is compared to the hurdle rate (cost of capital) to determine the financial viability of a project.

Economic Value Add (EVA)

The goal of EVA is to quantify the charge, or cost, of investing capital into a certain project or firm and to then assess whether it generates enough cash to be considered a good investment. The charge represents the minimum return that investors require to make their investment worthwhile. A positive EVA shows a project is generating returns in excess of the required minimum return.

Payback Period (PP)

Measured in time, the payback period shows how long it would take to recoup the investment. This analysis allows a comparison between potential projects. It is used to compare alternative investment opportunities and decide on a project that returns its investment in the shortest time.